10 Smart Ways to Get More Clients as a Financial Advisor

In today’s competitive landscape, business growth poses a significant challenge, particularly for financial advisors. The effectiveness of traditional advertising methods has diminished, as public trust in online ads diminishes.

This shifting dynamic has led many financial advisors to prioritize generating more referrals. Understandably, professionals in the finance industry aim to expand their client base without appearing overly aggressive or “sales-y” in their approach to asking for referrals. The good news is, it’s entirely possible to pursue growth without compromise.

By starting a referral program, financial advisors can cultivate a professional and mutually beneficial way to generate valuable referrals. Such programs not only enhance your business growth but also strengthen the trust and loyalty of your existing clients, making them more likely to recommend your services within their networks.

While it used to be an expensive and technical exercise to launch a refer a friend program, no-code referral program software has become both affordable and easy to use without technical expertise.

We’ve spoken to quite a few financial advisors over the past few months who are all facing the same challenges:

- The market has become incredibly crowded.

- People are hesitant to trust people they don’t know with their finances – even if they are “professionals”.

- It’s difficult to sell a product or service that isn’t tangible.

So, how can financial advisors get more clients? Here are four things that you can do to get quality customers for your financial advisory business.

Table of Contents

1. Create A Free Google My Business Listing

Registering your financial advisor business on Google My Business is an entirely free method to boost your online visibility and connect with potential clients actively searching for your services. By providing detailed information, your services become more accessible on Google’s platforms, such as Google Search and Google Maps.

When setting up your company profile, it’s crucial to incorporate relevant keywords that prospects might use to find your services. These should include your area of financial expertise—whether it’s investments, pensions, advisory services, or insurance—as well as the location of your reputable financial business. Such strategic keyword inclusion enhances your SEO, ensuring that when people search for your services, they find a professional and trustworthy profile.

2. Launch A Referral Program To Get More Referrals

When it comes to their finances, people trust recommendations from people they know. A referral program is an excellent way to leverage existing clients to source new prospects. Referral marketing tools like Referral Factory can help you build and launch a successful financial advisor referral program in minutes without needing a developer.

Launching a referral program as a financial advisor is a good idea for a few reasons:

- Grow your client base: a referral program can help you expand your client base by leveraging the network of your existing clients. When your satisfied clients refer their friends and network to your business, you gain access to a new pool of potential clients who are more likely to trust you since they were referred by someone they know and trust.

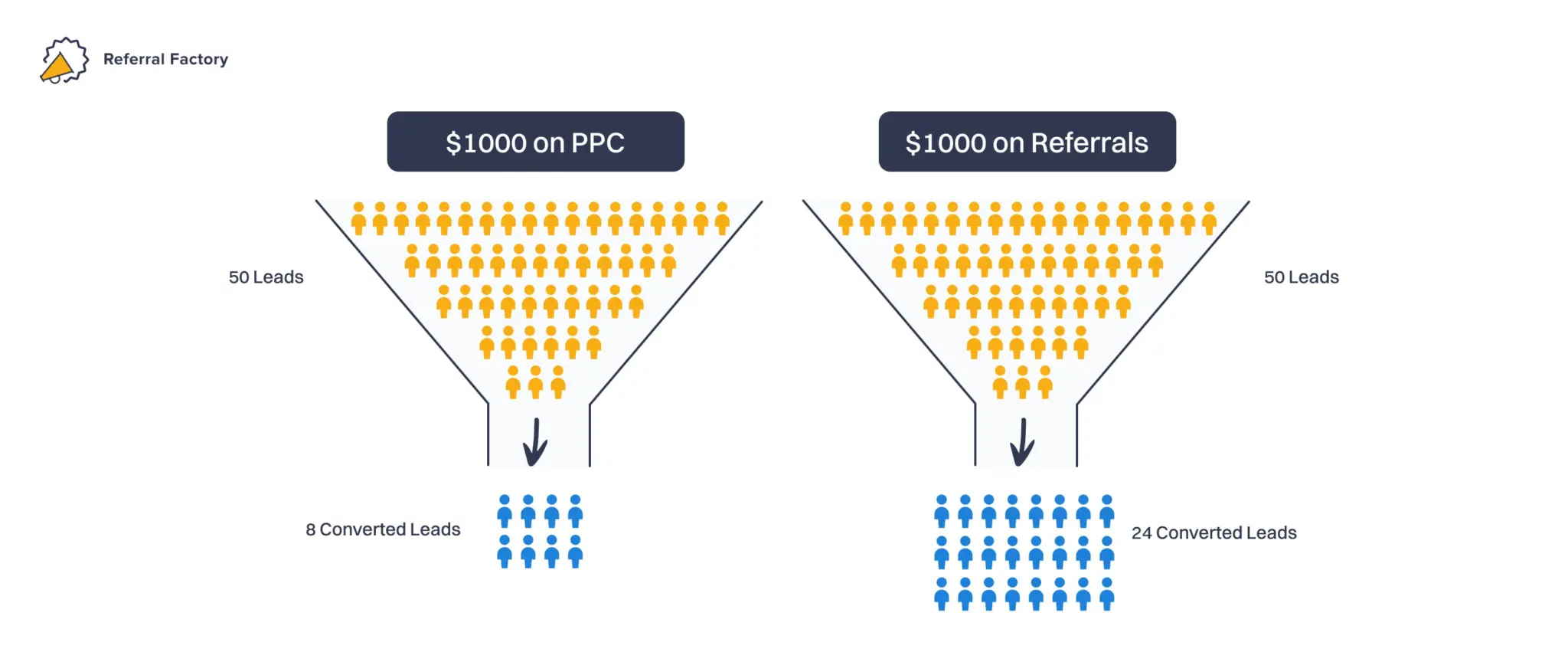

- Cost effective marketing: referral marketing is a cost-effective way to acquire new clients since you are not spending money on advertising channels that bring you low quality leads – like Google Ads, Facebook Ads, Linkedin Ads and others. You will have to financially reward your clients for every successful referral they send your way, but you’ll only need to pay out this reward on success – meaning you don’t have to waste any advertising budget on pay-per-click ads that more than likely, won’t convert.

- Higher quality leads: referrals tend to be higher quality leads since they are pre-qualified by the client who referred them. They are more likely to be interested in your services, and they may already have a good understanding of what you do.

- Builds trust and credibility: referral marketing helps to build trust and credibility with potential new clients. When someone is referred to you by a friend, colleague or family member, they are more likely to trust you and your financial services since they know that someone they trust has had a positive experience working with you.

- Improved client retention: clients who refer others to you are more likely to be loyal clients themselves. Referral marketing can also help strengthen your relationships with your existing clients because you’ll be rewarding them for helping you grow.

Overall, launching a referral program as a financial advisor can be a great way to acquire new clients, build trust and credibility, and improve client retention, all while being cost-effective. Check out this referral marketing guide for banking & financial services referral programs to guide you on launching your own referral program.

3. Develop a Strong Brand as a Financial Advisor

Building a strong brand is essential for financial advisors looking to distinguish themselves in a competitive market and attract the right clientele. A robust brand hinges on several core elements: authenticity and trust, a unique value proposition, a client-centric approach, a professional visual identity, and a consistent brand voice. These components ensure your brand resonates honesty and professionalism, tailors services to individual client needs, and maintains a cohesive appearance and tone across all platforms.

To effectively build and sustain your brand, focus on defining your mission and values, engaging in targeted content marketing, leveraging social media, networking at community events, and ensuring consistency across all communication channels. These strategies not only enhance your visibility but also establish you as a trustworthy expert in your field.

4. Host Webinars to Showcase Your Expertise

Hosting webinars is an effective strategy for financial advisors to engage prospects, showcase expertise, and generate leads. Here’s a streamlined approach:

Plan Your Webinar: Define clear goals, such as educating or generating leads. Choose relevant topics like retirement planning or tax strategies that align with your expertise. Structure your content clearly with an introduction, main points, and a Q&A session to maintain engagement.

Technical Setup: Use a reliable platform like Zoom or GoToWebinar that supports screen sharing and recording. Test your equipment beforehand to ensure a smooth presentation.

Market Your Webinar: Promote through email newsletters, social media, and collaborations. Simplify the registration process and offer multiple time slots to increase attendance.

Engage Your Audience: Encourage interactive participation and provide actionable insights during the webinar to establish credibility and trust.

Follow-Up: Send a thank-you email post-webinar with the session recording and additional resources. Offer follow-up consultations to convert leads into clients.

This focused approach helps financial advisors effectively use webinars to enhance visibility and grow their client base.

5. Leverage Social Media

Social media offers a powerful avenue for financial advisors to expand their reach and engage with potential clients. With billions of people active on various platforms, it provides a significant opportunity to connect, establish trust, and showcase expertise. Building a solid social media presence involves sharing valuable insights, responding to interactions, and maintaining a consistent posting schedule that aligns with the interests and needs of your target audience.

To maximize the effectiveness of your social media efforts, focus on platforms like LinkedIn for professional networking and Facebook for a more personal approach. Create engaging, visual content that educates and resonates with your audience, and be mindful of compliance with regulatory guidelines like those from FINRA and the SEC. Regular engagement and strategically tailored content will help establish your brand, build trust with followers, and ultimately grow your practice.

6. Create a Podcast Series

Launching a podcast can be a powerful strategy for financial advisors to enhance their brand and connect with clients. With the growing popularity of podcasts, this medium provides an ideal platform to showcase your expertise and establish authority by delivering valuable insights in areas such as retirement planning or rent vs. buy. Select topics that resonate with your target audience and choose a podcast format—whether solo, interviews, or with co-hosts—that keeps listeners engaged.

Begin by investing in quality equipment to ensure clear audio, and plan your episodes to include a mix of engaging content and practical advice while complying with industry regulations. Promote your podcast through social media and email campaigns, and consider creating a dedicated landing page on your website. By consistently delivering content that addresses the needs and interests of your audience, you can build a loyal listener base and position yourself as a trusted advisor in the financial sector.

7. Collaborative Workshops With Local Businesses

Collaborative workshops with local businesses represent a potent strategy for financial advisors to widen their reach and deepen community ties. By partnering with entities like real estate agencies or accounting firms, advisors can share resources—venue space, marketing efforts, and combined expertise—minimizing costs while maximizing the event’s impact.

Such collaborations not only broaden your audience by tapping into the established customer bases of partner businesses but also bolster your visibility and potential for client acquisition. Moreover, actively participating in these workshops underscores your commitment to the community, enhancing your reputation as a trusted financial resource.

When planning a workshop, it’s crucial to select partners with aligned interests and complementary services. Together, you can develop relevant topics that cater to the needs of both your clienteles, such as financial planning for entrepreneurs or retirement strategies for employees. Marketing the event through combined channels—like social media, email newsletters, and local flyers—will further extend its reach. Ensure the workshop is interactive to keep participants engaged, offering valuable takeaways like financial templates or exclusive resources.

8. Optimize Your Site For Search Engines (SEO)

Optimizing your financial advisor website for SEO involves a strategic approach centered on keyword research, content creation, and technical enhancements. Start by conducting thorough keyword research using tools like Google Keyword Planner and Ahrefs to identify both broad and specific terms your potential clients are searching for, including local phrases relevant to your area. This foundational step helps target a broader audience effectively.

Content quality is pivotal; regularly update your blog with informative posts that answer common financial questions, helping to establish you as an authority in the field. Diversifying your content types, such as incorporating videos, infographics, and podcasts, can cater to various preferences, enhancing engagement and SEO.

9. Leverage Email Marketing as a Financial Advisor

Email marketing serves as a vital tool for financial advisors, offering a direct and cost-effective way to communicate with clients and prospects. With a high return on investment, reportedly as much as $44 for every dollar spent, it stands out as a highly efficient marketing channel. It allows for personalized interactions, which are crucial in building and maintaining client relationships and retaining clients, with many expressing a preference for receiving advice via email.

To optimize your email marketing efforts, start by building a targeted email list using lead magnets like e-books or financial guides to attract interested prospects. Segment this list to tailor your communications more precisely to individual needs, enhancing engagement. Implement automated drip campaigns to nurture leads gradually, and personalize emails to boost engagement further. Monitoring key performance metrics is crucial to refine your strategies and maintain effectiveness. Lastly, ensure all your email marketing practices comply with relevant regulations like GDPR or CAN-SPAM to maintain trust and legality.

10. Build Interactive Infographics

Interactive infographics are a game-changer for financial advisors, turning complex data into engaging, easily digestible visual stories. By enabling users to click, scroll, and explore information, these tools make learning about financial topics an interactive experience, increasing retention and comprehension.

To effectively use interactive infographics, start by choosing data that aligns with your clients’ interests—think investment trends or savings tips. Design them to be visually appealing and easy to navigate, incorporating elements like clickable hotspots or animated charts to enhance engagement. Promote your infographics on social media, embed them in email campaigns, or use them as lead magnets to draw in more subscribers and expand your reach. This approach not only educates but also captivates your audience, driving engagement and ultimately helping to grow your client base.

Ready to launch your own referral program? You can generate one in a click, try it out by entering your website below…